Simplifying Monthly Bookkeeping For All

Simplifying Monthly Bookkeeping For All We'll handle Bookkeeping for Your Business

- QuickBooks / Xero / Wave Books Cleanup

- Monthly Bookkeeping

- Financial Reports

- Tax-Ready Books - Stress free tax season

- Certified Bookeepers with 7 Years of Experience

How It Works?

These are just some of the industries 4 simple process

Free Consultation

Book a free consultation our experts to discuss your Tax filing needs. We assess your situation and provide personalized guidance.

Provide Necessary Documents

Submit the required documents such as your passport, ITIN (if applicable), US income details, and business information, we ensure everything is in order.

Bookkeeping & Financial Organization

We help setup or cleanup yoour Quickbooks, Xero, or wave bookkeeping to ensure proper finacial tracking for better tax deductions and business growth.

Ongoing Support And Compliance

After filing we provide ongoing Tax planning, bookkeeping assistance, and compliance support to help you save money and avoid penalties.

Comparison

Bookkeeping Benefits vs No Bookkeeping

Bookkeeping helps you stay organized, avoid penalties, and make informed decisions. Without it, you risk errors, delays, and poor planning.

| Feature | With Bookkeeping/Cleanup | Without Bookkeeping/Cleanup |

|---|---|---|

| Accurate Financial Reports |

✓

Clean books provide clear financial reports

|

✕

Reports are inaccurate or unavailable

|

| Easy Tax Filing |

✓

Organized records simplify tax prep

|

✕

Hard to file taxes accurately and on time

|

| Better Business Decisions |

✓

Make informed financial decisions

|

✕

Decisions are made blindly

|

| Avoid IRS Penalties |

✓

Avoid late filings and fines

|

✕

Risk of IRS notices and penalties

|

| Know Business Profitability |

✓

See real profit, not just cash in bank

|

✕

You may think you’re earning but you’re not

|

| Catch Errors & Fraud Early |

✓

Detect unusual or unauthorized transactions

|

✕

Errors go unnoticed, leading to bigger issues

|

| Improve Cash Flow Management |

✓

Track money in/out and plan ahead

|

✕

Difficult to manage expenses and revenue

|

| Build Investor/Lender Trust |

✓

Reliable books increase business credibility

|

✕

May lose opportunities for investment

|

| Save Time & Reduce Stress |

✓

Less confusion and panic during audits

|

✕

Business operations become chaotic

|

| Meet Legal Requirements |

✓

Stay compliant with local and federal laws

|

✕

Possible legal issues, government penalties

|

| Understand What to Do Next (Business Direction) |

✓

Financials show what’s working and what needs fixing

|

✕

You operate blindly without direction or insight

|

Why You Need Monthly Bookkeeping

- Avoid errors and maintain reliable financial data for decision-making and tax preparation.

- Free up valuable time to focus on running your business while we handle your bookkeeping.

- Stay compliant with tax regulations and financial reporting requirements.

- Gain a clear understanding of your financial health with up-to-date reports.

- Enter tax season with confidence, knowing your books are ready.

Requirements for Monthly Bookkeeping

To get started, we”ll need:

- Access to your accounting software (QuickBooks, Xero, Wave, etc.).

- Bank and credit card statements.

- Details of outstanding invoices, bills, and payroll records.

- Any specific information about your business or financial processes.

Flexible Pricing Plan

Simple investment for everything your business needs

Whether you’re an individual, a small team, or a growing enterprise, we have a plan that aligns perfectly with your goals.

Basic

$149

- Monthly transaction categorization

- Bank & credit card reconciliation

- Profit & loss statement

- Balance sheet

- Cash flow summary

- Monthly financial insights

- Dedicated bookkeeper

- Accounts receivable tracking

- Accounts payable tracking

- Monthly review call

- Inventory tracking (if needed)

- Priority support

- Email support

- Multi-currency bookkeeping

Comprehensive

$299

- Monthly transaction categorization

- Bank & credit card reconciliation

- Profit & loss statement

- Balance sheet

- Cash flow summary

- Monthly financial insights

- Dedicated bookkeeper

- Accounts receivable tracking

- Accounts payable tracking

- Monthly review call

- Inventory tracking (if needed)

- Priority support

- Email support

- Multi-currency bookkeeping

Exclusive

$599

- Monthly transaction categorization

- Bank & credit card reconciliation

- Profit & loss statement

- Balance sheet

- Cash flow summary

- Monthly financial insights

- Dedicated bookkeeper

- Accounts receivable tracking

- Accounts payable tracking

- Monthly review call

- Inventory tracking (if needed)

- Priority support

- Email support

- Multi-currency bookkeeping

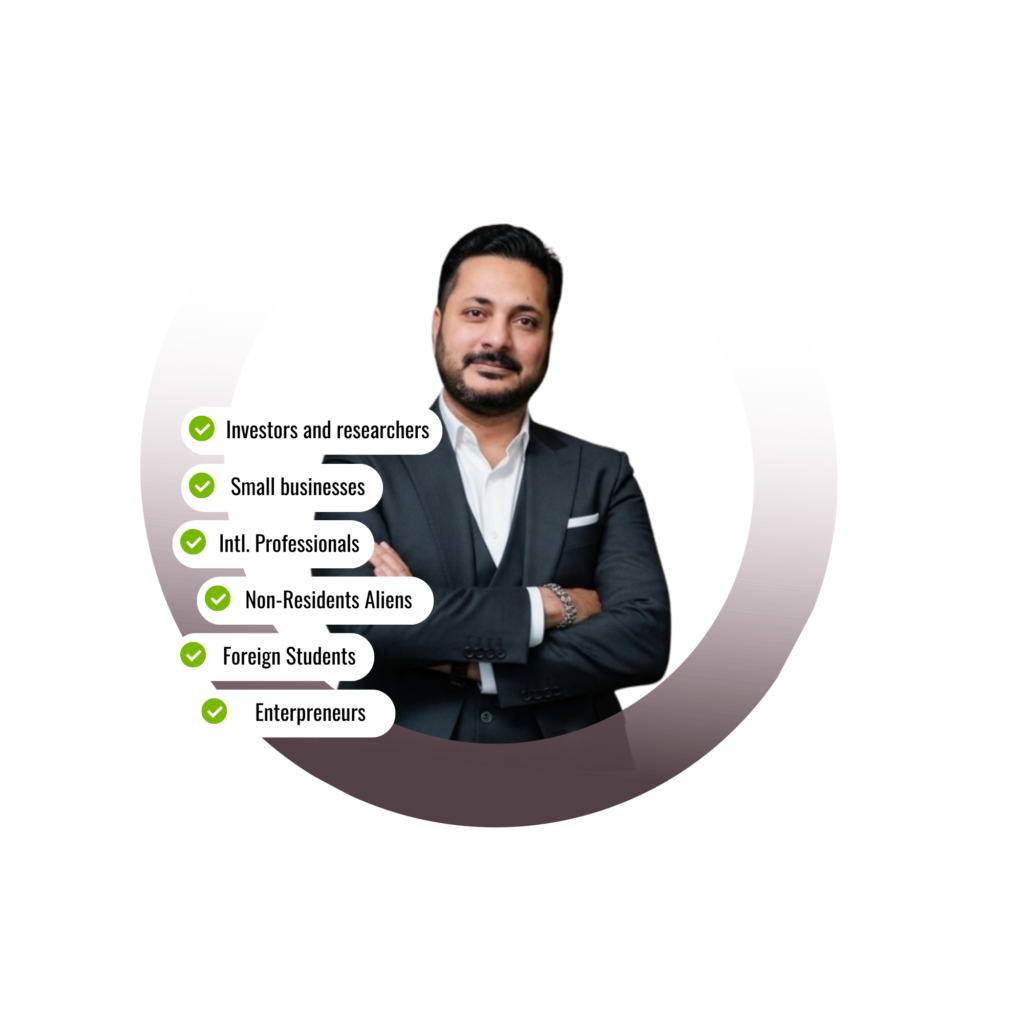

Who This Service Is For?

Our Monthly Bookkeeping services are ideal for:

- Roofers and Small businesses without dedicated accounting staff.

- Entrepreneurs managing growing operations and needing reliable financial data.

- E-commerce businesses with recurring transactions and revenue streams.

- Nonprofits requiring accurate records for donor reporting and compliance.

- Freelancers and consultants tracking income and expenses.

Industries We Serve

These are just some of the industries we serve

- Bookkeeper for small business

- Bookkeeper for Non-profit

- Bookkeeper for Startups

- Bookkeeper for Real estate

- Bookkeeper for Cleaning Business

- Bookkeeper for Law Firms

- Bookkeeper for Photographer

- Bookkeeper for Attorneys

- Bookkeeper for Churches

- Bookkeeper for Consultants

- Bookkeeper for Self employed

- Bookkeeper for Accounting Firms

- Bookkeeper for Content creators

- Bookkeeper for Electricians

- Bookkeeper for Restaurants

- Bookkeeper for Dentist

- Bookkeeper for property management

- Bookkeeper for Rooffers

- Bookkeeper for Landscaping business

- Bookkeeper for E-Commerce

- Bookkeeper for Tech Companies

- Bookkeeper for Freelancers

- Bookkeeper for Therapist

- Bookkeeper for Chiropractors

- Bookkeeper for Coaches

- Bookkeeper for Gyms

- Bookkeeper for HVAC companies

- Bookkeeper for Insurance Agencies

- Bookkeeper for Painters

- Bookkeeper for Doctors

- Bookkeeper for Automotive

- Bookkeeper for Coffee shop

- Bookkeeper for Construction companies

- Bookkeeper for Convenience store

- Bookkeeper for Wellness businesses

- Bookkeeper for Medical practices

- Bookkeeper for Therapist

- Bookkeeper for Trucking Companies

- Bookkeeper for Ebay, & Amazon sellers

- Bookkeeper for High Net worth Individuals

- Bookkeeper for Marketing & Advertising Agencies

- Bookkeeper for Mental Health professional

Key Features and Benefits

What Makes Our Service Stand Out

Expert Financial Management

Benefit from certified bookkeeping professionals with years of experience.

Tailored Solutions

Our services are customized to meet the unique needs of your business.

Timely Reports

Receive monthly financial reports for better visibility into your business performance.

Scalable Services

As your business grows, we can adjust our services to accommodate your needs

Trusted Experts

With years of CAA experience, we’ve helped countless clients secure their ITINs.

Client-Focused Service

We provide personalized attention to every application

Secure and Confidential

Your sensitive information is handled with the utmost care.

Transparent Pricing

No hidden fees—just reliable service at competitive rates.

Payment Security & Partner Trust

Your payment is protected with Stripe — one of the most secure gateways in the world.

FAQs

Our service includes transaction recording, categorization, reconciliation, and financial reporting to ensure your records are accurate and complete.

We provide monthly updates, but we’re available for additional support or reporting as needed.

No, we work with various platforms, including QuickBooks, Xero, Wave, and Zoho Books.

Yes, we can integrate payroll management and coordinate with your tax professional for seamless tax preparation.

Absolutely. We use encrypted systems and follow strict data confidentiality protocols.