U.S. ITIN (IRS) for Non Residents

Trusted by international clients worldwide. We handle your ITIN application with expert care, guaranteed results, and personalized support throughout the entire process.

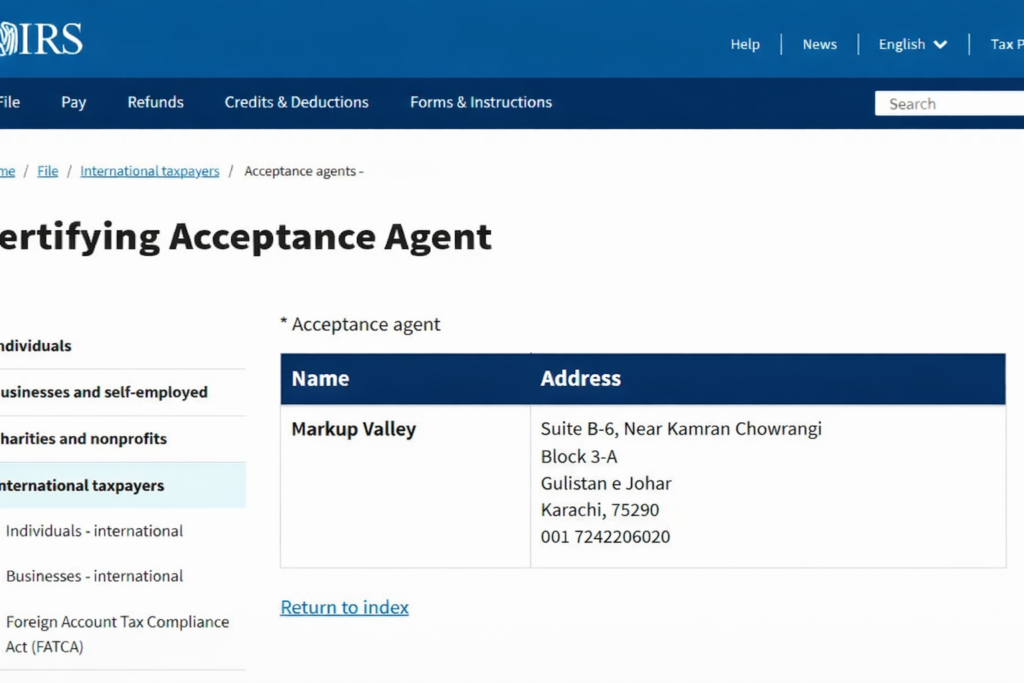

- IRS CERTIFIED ACCEPTANCE AGENT

- 10,000+ CLIENTS SERVED

1-7 Days

Processing Time

100% secure

Data Protection

Guaranteed

Success Rate

567+ REVIEWS

Book A call Form

Flexible Pricing Plan

Choose the Right Plan for Your ITIN Need

Whether you’re an individual, a small team, or a growing enterprise, we have a plan that aligns perfectly with your goals.

Standard ITIN Preparation

$200

$400

- Document review & CAA verification (no passport mailing)

- Complete ITIN application preparation

- Submission within 5-7 business days

- No Hidden Fees

Priority ITIN Preparation

$300

$500

- All features of Standard ITIN Preparation Service

- Fast-track prep (1–2 business days)

- 100% Money‑Back Guarantee

- Priority handling & support

- FedEx tracking Number

- Step‑by‑step updates

Get ITIN by IRS Certified Acceptance Agent (CAA)

As an IRS-authorized Certified Acceptance Agent (CAA), we make the ITIN application process fast, secure, and stress-free — even if you’re outside the U.S.

- No need to send your original passport

- Professional document review & submission

- Expert guidance every step of the way

- Support for dependents, spouses, and businesses

An ITIN is for people who need to file U.S. taxes but aren’t eligible for a Social Security Number (SSN).

You may need an ITIN if you are:

- A non-U.S. citizen earning income from U.S. sources (like rental property or business).

- A spouse or dependent listed on a U.S. tax return.

- A foreign owner of a U.S. LLC required to file taxes.

Payment Security & Partner Trust

Your payment is protected with Stripe — one of the most secure gateways in the world.