Confused Between an ITIN and EIN? Here’s a Simple Guide for Non-U.S. Business Owners

If you’re starting a business in the U.S. — especially as a non-resident — you’re going to hear a lot about ITINs and EINs.

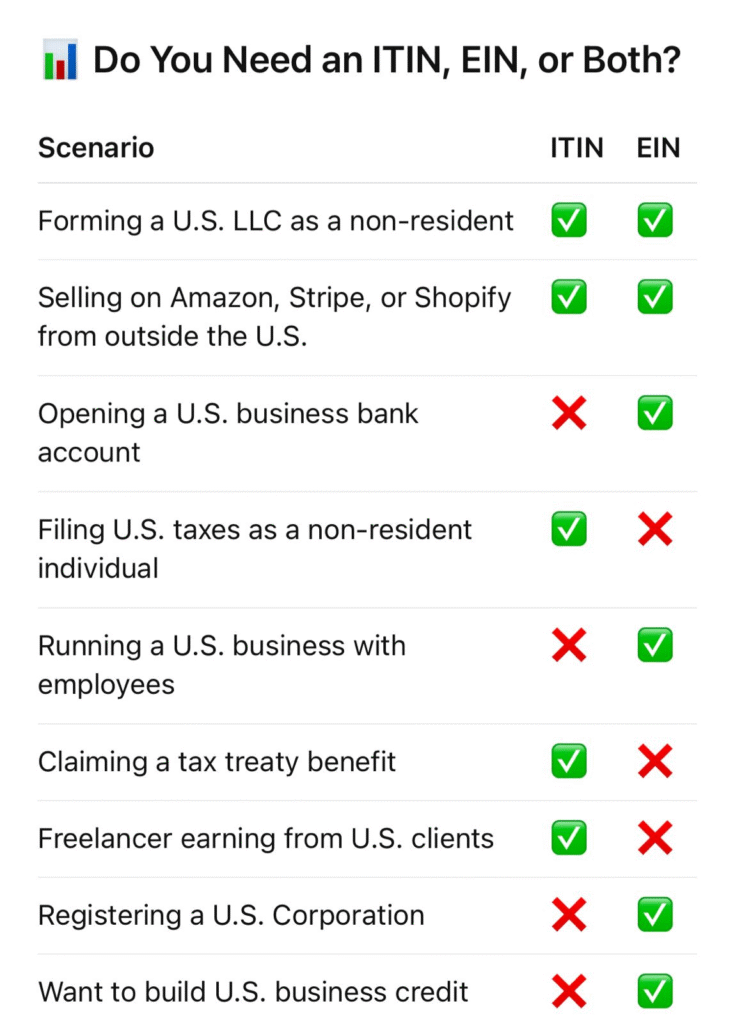

They sound similar, but they serve very different purposes.

At Markup Valley, we help entrepreneurs from around the world understand which one they need — and how to get it fast.

What Is an EIN?

EIN stands for Employer Identification Number. It’s like a Social Security Number for your business.

You’ll need an EIN if:

- You’re forming a U.S. LLC or Corporation

- You want to open a U.S. business bank account

- You’re hiring employees in the U.S.

- You want to file business taxes

Issued by: Internal Revenue Service (IRS)

Who gets it: Business entities (LLCs, Corporations, Partnerships)

What Is an ITIN?

ITIN stands for Individual Taxpayer Identification Number. It’s a tax ID for individuals who are not eligible for a Social Security Number (SSN).

You’ll need an ITIN if:

- You’re a non-resident earning U.S. income

- You’re part of a U.S. LLC as a foreign owner

- You want to file a U.S. tax return

- You need to claim a tax treaty benefit

Issued by: Internal Revenue Service (IRS)

Who gets it: Individuals — not businesses

Why It Matters

Trying to open a Stripe, Payoneer, or Amazon seller account without the correct tax ID can get your application rejected or flagged.

Also, filing taxes without the correct ID? That could lead to penalties or delays.

That’s where we come in.

Markup Valley: Your Trusted Partner for ITIN & EIN

- Fast EIN processing (within 24–48 hours in many cases)

- Complete ITIN application & IRS submission

- Support for non-residents from Pakistan, India, UAE, Africa, and more

- Guidance on what you really need — and what you don’t

Ready to Get the Right Tax ID?

Don’t guess. Let our experts guide you through the process with zero stress.

This is a great reminder that financial planning isn’t just about numbers; it’s about aligning your money with your life goals. Physician Lifecycle Planning can help you make the most of your earning potential while ensuring you’re also prioritizing your well-being and quality of life.